Why U.S. Sanctions Hit Harder Than China Can Retaliate

- unpopdisc

- Dec 5, 2024

- 4 min read

In recent years, the media has portrayed China as a rising technological superpower poised to rival the United States, Europe, and Japan. This perception has been fuelled by state-driven propaganda amplified through global media and orchestrated campaigns on social networks. It is common to see short videos on Instagram and TikTok telling you “this is designed by China!”, “this is Chinese technology” etc., posted by bloggers ostensibly from Europe, Africa or Latin America. However, a closer examination of the underlying economic and technological realities reveals a more constrained and dependent Chinese economy. Despite its apparent strength, China remains vulnerable to U.S.-led sanctions, while its capacity for meaningful retaliation is limited.

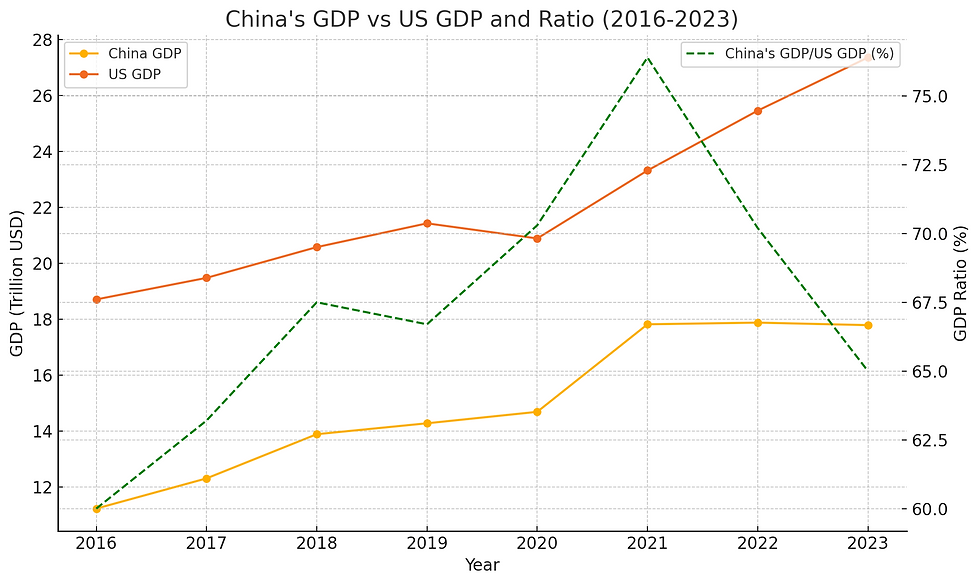

Contrary to popular belief, From 2020 to 2023, the technological and economic gap between the U.S. and China widened. According to the World Bank and IMF data, China’s share of the global economy shrank in real terms, with the EU surpassing China in GDP size by 2023. Given concerns over inflated Chinese statistics, this gap may be even more significant than reported. Summarising relevant research, at least eight critical structural weaknesses of China's economy can explain why U.S. sanctions have been able to devastate China’s strategic industries, while China’s ability to retaliate remains limited.

1. Dependency on Foreign Technology

Despite China’s ambitions to dominate advanced industries, its dependence on foreign technology remains severe. Concerning the latest focus on semiconductor technology, China consumed 60% of the world’s semiconductors but produced only 16% domestically by 2023. Advanced chips below 7 nm, essential for AI, smartphones and military tech, rely on U.S. companies like NVIDIA, Qualcomm and Dutch chipmaker ASML. The Huawei sanctions are a cautionary tale: its global smartphone market share collapsed from 18% in 2020 to less than 2% in 2023, demonstrating its reliance on foreign chip-making technologies. Similar conditions can be seen in almost every strategical industry in China, varying from the metallurgical industry to its proud EV industry, though not frequently reported by the media.

2. Lack of Substitutes in Strategic Industries

China’s technological ecosystem still relies heavily on foreign suppliers in critical sectors. In aviation, for instance, the C919 passenger jet, symbolising China’s aerospace ambitions, uses 80% foreign components, most of which are U.S.-made engines and avionics. Similarly, over 60% of China’s high-end manufacturing equipment comes from Japan, South Korea and the U.S. As such, a U.S. export ban targeting this sector would cripple China’s industrial production within months.

3. China’s Retaliatory Constraints

Since the first Trump presidency, China’s retaliatory tools have proven ineffective when tested in a real-world context. For example, while China dominates 60% of global rare earth production, efforts to weaponise this resource failed. After China cut exports to Japan in 2010, other countries ramped up production, reducing China’s leverage by 2023.

As for leveraging the market access threats, we have observed that blocking foreign companies like Tesla or Apple would hurt China’s economy more than the targeted firms due to lost investment and technological spillover effects.

4. Limited Foreign Dependence on Chinese Tech

Unlike China’s reliance on foreign technology, global economies are not dependent on Chinese tech companies. U.S. tech giants like Amazon Web Services control 40% of the global cloud market, compared to Alibaba’s 6%. Chinese platforms like Tencent’s WeChat generate less than 10% of their revenue abroad, highlighting limited global reach and market dependence on domestic consumers.

5. Economic and Trade Asymmetries

China’s economic structure leaves it more exposed to trade wars than its rivals. Exports make up 18% of China’s GDP, with the U.S. accounting for $540 billion in trade in 2023. In comparison, U.S. exports to China were only $153 billion, indicating an asymmetrical trade relationship.

As for China on the capital market, 80% of foreign-listed Chinese companies depend on U.S. capital markets. We have witnessed how even a moderate crackdown on Chinese listings in the US has significantly restricted China’s global fundraising capacity.

6. Structural Weakness in Innovation

China has made strides in innovation but remains fundamentally dependent on foreign intellectual property. In 2022, Chinese firms paid $9 billion in royalties to U.S. tech companies for technology licensing. Despite investing 2.4% of GDP into R&D, China trails in fundamental sciences and key technologies like AI, biotechnology and quantum computing. The vast majority of Chinese research projects are either replications of old innovations from the West (but propagandised as “Chinese innovations” by the state media) or applications based on the latest innovations from the West.

7. Historical Impact of U.S. Sanctions

Several examples illustrate how U.S. sanctions can swiftly cripple Chinese industries:

• Semiconductor Industry: The 2022 U.S. chip export ban caused severe disruptions to China’s AI and supercomputing ambitions. Domestic Chinese alternatives were unable to fill the gap.

• Telecom Sector: Huawei lost access to Google services and cutting-edge chips, causing its smartphone production to fall by 75% by 2023.

• Defence and Aerospace: Sanctions delayed China’s plans to compete with Boeing and Airbus, keeping the Chinese aerospace industry underdeveloped.

8. Inability to Block Foreign Rivals

China’s retaliatory tools have been largely symbolic or ineffective:

• Global Standards Dependency: Western-led organisations dominate international tech standards, ensuring China’s limited influence.

• Supply Chain Interdependence: China’s manufacturing supremacy is counterbalanced by its dependence on imported components. Any attempt to restrict exports would harm its own industries first.

Conclusion

Despite its narrative as a rising tech superpower, China’s structural dependencies leave its economy and strategic industries highly exposed to U.S.-led sanctions. Its retaliatory tools are limited by asymmetrical trade relationships, supply chain vulnerabilities, and a lack of control over critical technologies. The widening U.S.-China gap from 2020 to 2023 reflects these underlying weaknesses, emphasising that China’s global tech dominance remains a myth more than reality.

The next time headlines proclaim China’s inevitable rise, a more in-depth look at its dependency on foreign technology and market access might tell a different story. U.S. sanctions hit harder — and China has little leverage to hit back.

Comments